by Calculated Risk on 11/07/2014 10:00:00 AM

Friday, November 07, 2014

Comments: Solid Employment Report, Seasonal Retail Hiring at Record Level

Earlier: October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

This was another solid report with 214,000 jobs added, and job gains for August and September were revised up. This was the ninth consecutive month over 200,000, and an all time record 49th consecutive month of job gains.

As always we shouldn't read too much into one month of data, but at the current pace (through October), the economy will add 2.74 million jobs this year (2.67 million private sector jobs). Right now 2014 is on pace to be the best year for both total and private sector job growth since 1999.

A few other positives: the unemployment rate declined to 5.8% (the lowest level since July 2008), U-6 declined to 11.5% (an alternative measure for labor underutilization) and was at the lowest level since 2008, the number of part time workers for economic reasons declined slightly (lowest since October 2008). And the number of long term unemployed declined to the lowest level since January 2009.

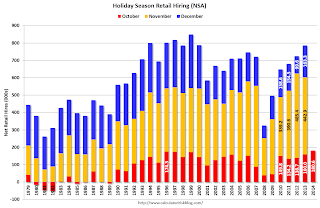

Also seasonal retail hiring was at a record level. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

Unfortunately wage growth is still subdued. From the BLS: "Average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.57 in October. Over the year, average hourly earnings have risen by 2.0 percent. In October, average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $20.70."

With the unemployment rate at 5.8%, there is still little upward pressure on wages. Wages should pick up as the unemployment rate falls over the next couple of years, but with the currently low inflation and little wage pressure, the Fed will likely remain patient.

A few more numbers:

Total employment increased 214,000 from September to October and is now 1.3 million above the previous peak. Total employment is up 10.0 million from the employment recession low.

Private payroll employment increased 209,000 from September to October, and private employment is now 1.8 million above the previous peak (the unprecedented large number of government layoffs has held back total employment). Private employment is up 10.6 million from the recession low.

Through the first ten months of 2014, the economy has added 2,285,000 payroll jobs - up from 1,973,000 added during the same period in 2013. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year. That still looks about right.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in October at the highest level since 1999.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 180.6 thousand workers (NSA) net in October. This is the all time record (just above 1996). Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are optimistic about the holiday season. Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales.

Year-over-year Change in Employment

In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing.

Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

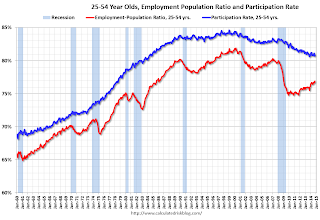

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in October to 80.8% from 80.7% in September, and the 25 to 54 employment population ratio increased to 76.9% from 76.7%. As the recovery continues, I expect the participation rate for this group to increase a little - although the participation rate has been trending down for this group since the late '90s.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged in October at 7.0 million.The number of persons working part time for economic reasons decreased in October to 7.027 million from 7.103 million in September. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.5% in October from 11.8% in September.

This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.916 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.954 in September. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In October 2014, state and local governments added 8,000 jobs. State and local government employment is now up 146,000 from the bottom, but still 598,000 below the peak.

Clearly state and local employment is now increasing. And Federal government layoffs have slowed (payroll decreased by 3 thousand in October), but Federal employment is still down 25,000 for the year.