by Calculated Risk on 12/17/2014 09:34:00 AM

Wednesday, December 17, 2014

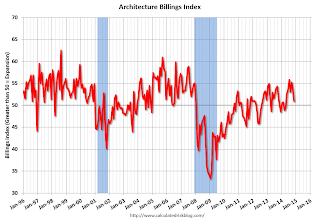

AIA: Architecture Billings Index shows slower expansion in November

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Demand Softens, but Outlook for Architecture Billings Index Remains Positive

Buoyed by sustained demand for apartments and condominiums, coupled with state and local governments moving ahead with delayed public projects, the Architecture Billings Index (ABI) has been positive for seven consecutive months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 50.9, down from a mark of 53.7 in October. This score reflects a slight increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.8, following a mark of 62.7 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in November was 54.9.

“Demand for design services has slowed somewhat from the torrid pace of the summer, but all project sectors are seeing at least modest growth,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Architecture firms are expecting solid mid-single digit gains in revenue for 2014, but heading into 2015, they are concerned with finding quality contractors for projects, coping with volatile construction materials costs and with finding qualified architecture staff for their firms.”

• Regional averages: South (57.9), West (52.7), Midwest (49.8), Northeast (46.7) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in November, down from 53.7 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the positive readings over the last seven months suggest an increase in CRE investment in 2015.