by Calculated Risk on 12/11/2014 12:23:00 PM

Thursday, December 11, 2014

Fed's Flow of Funds: Household Net Worth "dipped slightly" in Q3

The Federal Reserve released the Q3 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth decreased slightly in Q3 compared to Q2:

The net worth of households and nonprofits dipped slightly to $81.3 trillion during the third quarter of 2014. The value of directly and indirectly held corporate equities decreased $0.7 trillion and the value of real estate rose $245 billion.Prior to the recession, net worth peaked at $67.9 trillion in Q2 2007, and then net worth fell to $54.9 trillion in Q1 2009 (a loss of $13.0 trillion). Household net worth was at $81.3 trillion in Q3 2014 (up $26.4 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.4 trillion in Q3 2014. The value of household real estate is still $2.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is above peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up but decreased slightly in Q3.

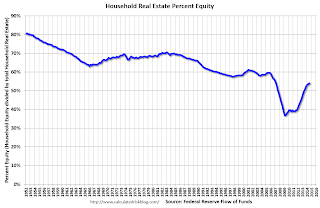

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2014, household percent equity (of household real estate) was at 53.9% - up from Q2, and the highest since Q1 2007. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 53.9% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $12 billion in Q3.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was down in Q3 (as GDP increased faster than house prices), and somewhat above the average of the last 30 years (excluding bubble).