by Calculated Risk on 12/16/2014 08:30:00 AM

Tuesday, December 16, 2014

Housing Starts decrease to 1.028 Million Annual Rate in November

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,028,000. This is 1.6 percent below the revised October estimate of 1,045,000 and is 7.0 percent below the November 2013 rate of 1,105,000.

Single-family housing starts in November were at a rate of 677,000; this is 5.4 percent below the revised October figure of 716,000. The November rate for units in buildings with five units or more was 340,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,035,000. This is 5.2 percent below the revised October rate of 1,092,000 and is 0.2 percent below the November 2013 estimate of 1,037,000.

Single-family authorizations in November were at a rate of 639,000; this is 1.2 percent below the revised October figure of 647,000. Authorizations of units in buildings with five units or more were at a rate of 367,000 in November.

Click on graph for larger image.

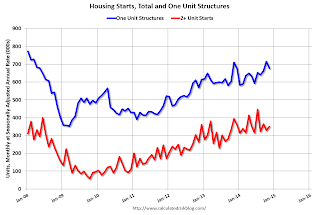

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in November (Multi-family is volatile month-to-month). Multi-family starts are down 11% year-over-year because there was a large increase in starts last November.

Single-family starts (blue) decreased in November.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was below expectations of 1.038 million starts in November, however October was revised up by 36 thousand (annual rate), so overall this was a decent report. The comparison to last year was difficult because of the large increase in starts in November 2013 (that probably was one of the reasons many analysts were too optimistic for 2014). I'll have more later ...