by Calculated Risk on 3/20/2015 01:30:00 PM

Friday, March 20, 2015

Zillow: Negative Equity Rate unchanged in Q4 2014

From Zillow: Even as Home Values Rise, Negative Equity Rate Flattens

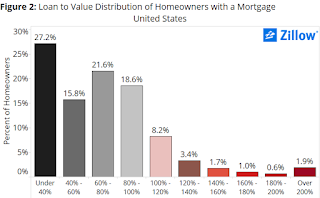

In the fourth quarter of 2014, the U.S. negative equity rate – the percentage of all homeowners with a mortgage that are underwater, owing more on their home than it is worth – stood at 16.9 percent, unchanged from the third quarter. Negative equity had fallen quarter-over-quarter for ten straight quarters, or two-and-a-half years, prior to flattening out between Q3 and Q4 of last year.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q4 2014.

While this may not seem very notable (after all, overall negative equity didn’t go up, merely flattened out), this represents a major turning point in the housing market. The days in which rapid and fairly uniform home value appreciation contributed to steep drops in negative equity are behind us, and a new normal has arrived. Negative equity, while it may still fall in fits and spurts, is decidedly here to stay, and will impact the market for years to come.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Nationally, of the homeowners who are underwater, around half are only underwater by 20 percent or less, which is to say they are close to escaping negative equity. (Figure 2) On the other hand, 1.9 percent of all owners with a mortgage remain deeply underwater, owing at least twice what their home is worth. Of the largest metro areas, markets with above average rates of deeply underwater homeowners include Las Vegas (3.8 percent), Chicago (3.8 percent), Atlanta (3.5 percent), Detroit (3.3 percent) and Miami (2.8 percent)Almost half of the borrowers with negative equity have a LTV of 100% to 120% (8.2% in Q4 2014). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or their loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for ten years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 5.2% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic released their Q4 2014 negative equity earlier this week. For Q4, CoreLogic reported there were 5.4 million properties with negative equity, up slightly from Q3.