by Calculated Risk on 4/01/2015 10:04:00 AM

Wednesday, April 01, 2015

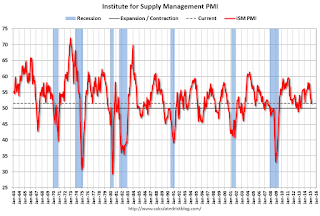

ISM Manufacturing index declined to 51.5 in March

The ISM manufacturing index suggests slower expansion in March than in February. The PMI was at 51.5% in March, down from 52.9% in February. The employment index was at 50.0%, down from 51.4% in February, and the new orders index was at 51.8%, down from 52.5%.

From the Institute for Supply Management: March 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March for the 27th consecutive month, and the overall economy grew for the 70th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.On that last sentence - the good news is the West Cost port slowdown has been resolved, although it will take a few months to catch up.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The March PMI® registered 51.5 percent, a decrease of 1.4 percentage points from February’s reading of 52.9 percent. The New Orders Index registered 51.8 percent, a decrease of 0.7 percentage point from the reading of 52.5 percent in February. The Production Index registered 53.8 percent, 0.1 percentage point above the February reading of 53.7 percent. The Employment Index registered 50 percent, 1.4 percentage points below the February reading of 51.4 percent, reflecting unchanged employment levels from February. Inventories of raw materials registered 51.5 percent, a decrease of 1 percentage point from the February reading of 52.5 percent. The Prices Index registered 39 percent, 4 percentage points above the February reading of 35 percent, indicating lower raw materials prices for the fifth consecutive month. Comments from the panel refer to continuing challenges from the West Coast port issue, lower oil prices having both positive and negative impacts depending upon the industry, residual effects of the harsh winter, higher costs of healthcare premiums, and challenges associated with the stronger dollar on international business."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.5%, but still indicates expansion in March.