by Calculated Risk on 4/20/2015 11:01:00 AM

Monday, April 20, 2015

LA area Port Traffic Increased Sharply in March following resolution of Labor Issues

Note: LA area ports were impacted by labor negotiations that were settled on February 21st.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report for February since LA area ports handle about 40% of the nation's container port traffic.

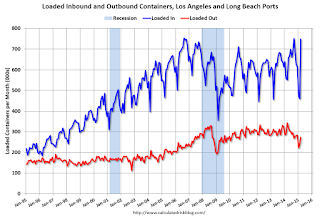

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.6% compared to the rolling 12 months ending in February. Outbound traffic was down 2.0% compared to 12 months ending in February.

Inbound traffic had been increasing, and outbound traffic had been mostly moving sideways or slightly down. The recent downturn in exports might be more than just the labor issues (strong dollar, weakness in China).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 36% year-over-year in March, exports were down 20% year-over-year.

The labor issues are now resolved - the ships have disappearing from the outer harbor - and the distortions from the labor issues will mostly be behind us in April.