by Calculated Risk on 4/29/2015 11:59:00 AM

Wednesday, April 29, 2015

Q1 GDP: Investment

Note: I'll probably be late to the FOMC analysis party today. No change in policy is expected. Here is the link for the statement at 2:00 PM ET.

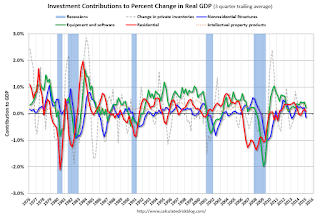

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 1.3% annual rate in Q1. Equipment investment increased at a 0.1% annual rate, and investment in non-residential structures decreased at a 23.1% annual rate. On a 3 quarter trailing average basis, RI is slightly positive (red), equipment is a slower positive (green), and nonresidential structures are down (blue).

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline.

I expect investment to be solid going forward (except for energy and power), and for the economy to grow at a decent pace for the remained of 2015.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I'll add details for investment in offices, malls and hotels after the supplemental data is released.