by Calculated Risk on 6/24/2015 10:12:00 AM

Wednesday, June 24, 2015

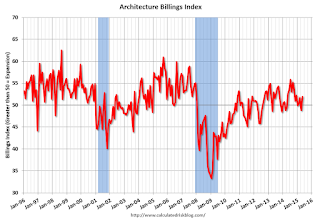

AIA: Architecture Billings Index increased in May

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Returns to Positive Territory

Led by growing demand for new schools, hospitals, cultural facilities and municipal buildings, the Architecture Billings Index (ABI) increased in May following its second monthly drop this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 51.9, up from a mark of 48.8 in April. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.5, up from a reading of 60.1 the previous month.

“As has been the case for the past several years, while the design and construction industry has been in a recovery phase, we continue to receive mixed signals on business conditions in the marketplace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Generally, the business climate is favorable, but there are still construction sectors and regions of the country that are struggling, producing the occasional backslide in the midst of what seems to be growing momentum for the entire industry.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in May, up from 48.8 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the fourth consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting an increase in CRE investment in 2015.