by Calculated Risk on 6/30/2015 09:16:00 AM

Tuesday, June 30, 2015

Case-Shiller: National House Price Index increased 4.2% year-over-year in April

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Ease in April According to the S&P/Case-Shiller Home Price Indices

Both Composites and the National index showed slightly lower year-over-year gains compared to last month. The 10-City Composite gained 4.6% year-over-year, while the 20-City Composite gained 4.9% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.2% annual gain in April 2015 versus a 4.3% increase in March 2015.

...

Before seasonal adjustment, the National index increased 1.1% in April and the 10-City and 20-City Composites posted gains of 1.0% and 1.1% month-over-month. After seasonal adjustment, the National index was unchanged; the 10- and 20-city composites were up 0.3% and 0.4%. All 20 cities reported increases in April before seasonal adjustment; after seasonal adjustment, 12 were up and eight were down.

emphasis added

Click on graph for larger image.

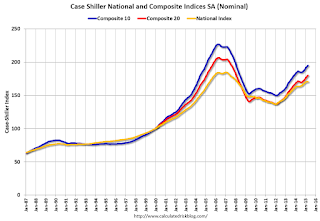

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.1% from the peak, and up 0.4% in April (SA).

The Composite 20 index is off 12.9% from the peak, and up 0.3% (SA) in April.

The National index is off 7.6% from the peak, and unchanged (SA) in April. The National index is up 24.8% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.6% compared to April 2014.

The Composite 20 SA is up 4.9% year-over-year..

The National index SA is up 4.2% year-over-year.

Prices increased (SA) in 12 of the 20 Case-Shiller cities in April seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 40.1% from the peak, and prices in Denver are at a new high (SA).

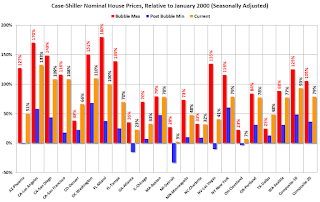

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 51% above January 2000 (51% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 11% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.