by Calculated Risk on 8/10/2015 07:37:00 PM

Monday, August 10, 2015

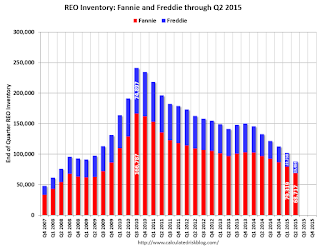

Fannie and Freddie: REO inventory declined in Q2, Down 33% Year-over-year

Fannie and Freddie reported results last week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae:

The continued decrease in the number of our seriously delinquent single-family loans has resulted in a reduction in the number of REO acquisitions in the first half of 2015 as compared with the first half of 2014.Fannie is unable to currently market about 40% of their inventory.

We continue to manage our REO inventory to appropriately manage costs and maximize sales proceeds. However, we are unable to market and sell a large portion of our inventory, primarily due to occupancy and state or local redemption or confirmation periods, which extends the amount of time it takes to bring our properties to a marketable state and eventually dispose of them. This results in higher foreclosed property expenses, which include costs related to maintaining the property and ensuring that the property is vacant. Additionally, before we market our foreclosed properties, we may choose to repair them in order to maximize the sales price and increase the likelihood that an owner occupant will purchase. The percent of properties we repair prior to marketing has increased as a result of market demand and our continued focus on stabilizing neighborhoods and increasing opportunities for owner occupants to purchase.

emphasis added

From Freddie Mac:

In recent periods, third-party sales at foreclosure auction have comprised an increasing portion of foreclosure transfers. Third-party sales at foreclosure auction avoid the REO property expenses that we would have otherwise incurred if we held the property in our REO inventory until disposition.Fannie and Freddie are still working through the backlog of loans made during the housing bubble, mostly in judicial foreclosure states.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 for both Fannie and Freddie, and combined inventory is down 33% year-over-year. For Freddie, this is the lowest level of REO since Q1 2008. For Fannie, this is the lowest level since Q2 2009.

Short term delinquencies are at normal levels, but there are still a fairly large number of properties in the foreclosure process with long time lines in judicial foreclosure states.