by Calculated Risk on 8/13/2015 11:34:00 AM

Thursday, August 13, 2015

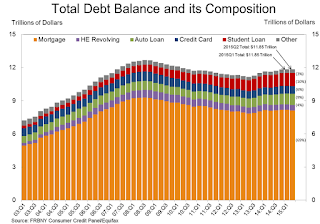

NY Fed: Household Debt "Flat" in Q2 2015

Here is the Q2 report: Household Debt and Credit Report.

From the NY Fed: Auto Loans Race Ahead, Foreclosures Plunge, and Overall Household Debt Remains Flat

Household debt balances were largely flat in the second quarter of this year, according to the Federal Reserve Bank of New York’s Household Debt and Credit Report. Total indebtedness increased just $2 billion from Q1 2015. Foreclosures hit their lowest point in the 16-year history of the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Auto loan originations reached a 10-year high in the second quarter, at $119 billion, supporting a $38 billion increase in the aggregate auto loan balance, which has now passed $1 trillion. The increase in auto loans also drove most of the $67 billion increase in non-housing debt balances. Credit card balances increased, by $19 billion, to $703 billion, while student loan balances remained flat. Mortgage balances and HELOC dropped by $55 billion and $11 billion, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased slightly in Q2. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests household (in the aggregate) deleveraging is over although mortgage debt is still declining (foreclosures of legacy loans continue).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased to 5.6% in Q2, from 5.7% in Q1.

There are a number of credit graphs at the NY Fed site.