by Calculated Risk on 11/17/2015 10:28:00 AM

Tuesday, November 17, 2015

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q3

From the MBA: Mortgage Foreclosures and Delinquencies Continue to Drop

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.99 percent of all loans outstanding at the end of the third quarter of 2015. This was the lowest level since the first quarter of 2007. The delinquency rate decreased 31 basis points from the previous quarter, and 86 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.88 percent, down 21 basis points from the second quarter and 51 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the third quarter of 2007.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.38 percent, a decrease of two basis points from the previous quarter, and down six basis points from one year ago. The foreclosure starts rate is at the lowest level since the second quarter of 2005.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 3.57 percent, a decrease of 38 basis points from last quarter, and a decrease of 108 basis points from last year. This was the lowest serious delinquency rate since the third quarter of 2007.

Click on graph for larger image.

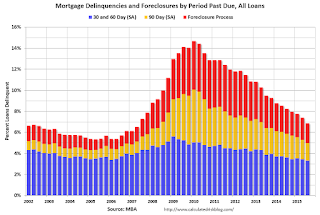

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 85% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 80% of the way back to normal.

So it has taken 5 1/2 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 80%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.