by Calculated Risk on 12/29/2015 02:01:00 PM

Tuesday, December 29, 2015

Question #9 for 2016: What will happen with house prices in 2016?

Over the weekend, I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% or so in 2015 (after increasing 7% in 2012, 11% in 2013, and 5% in 2014 according to Case-Shiller). What will happen with house prices in 2016?

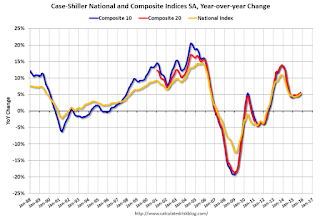

The following graph shows the year-over-year change in the seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 5.1% compared to October 2014, the Composite 20 SA was up 5.6% and the National index SA was up 5.2% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-15 | 5.6% |

| Case-Shiller National | Oct-15 | 5.2% |

| CoreLogic | Oct-15 | 6.8% |

| Zillow | Oct-15 | 4.3% |

| Black Knight | Sept-15 | 5.1% |

| FNC | Oct-14 | 5.9% |

| FHFA Purchase Only | Oct-15 | 6.1% |

There were some special factors in 2012 and 2013 that led to sharp price increases. This included limited inventory, fewer foreclosures, continued investor buying in certain areas, and a change in psychology as buyers and sellers started believing house prices had bottomed. In some areas, like Phoenix, there appeared to be a strong bounce off the bottom, but that bounce mostly ended in 2014.

Currently investor buying has slowed, as have distressed sales - however inventory is still low in many areas. In 2016, inventories will probably remain low, but I expect inventories to increase on a year-over-year basis.

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?