by Calculated Risk on 1/01/2016 11:20:00 AM

Friday, January 01, 2016

December 2015: Unofficial Problem Bank list declines to 250 Institutions, Q4 2015 Transition Matrix

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2015. During the month, the list fell from 264 institutions to 250 after eight removals and three additions. Assets dropped by $2.0 billion to an aggregate $74.97 billion. A year ago, the list held 401 institutions with assets of $125.1 billion.

This month, actions have been terminated against Fieldpoint Private Bank & Trust, Greenwich, CT ($786 million); Broadway Federal Bank, f.s.b., Los Angeles, CA ($404 million); Lifestore Bank, West Jefferson, NC ($256 million); American National Bank of Minnesota, Baxter, MN ($251 million); Fidelity Bank of Florida, National Association, Merritt Island, FL ($229 million); Mid-Southern Savings Bank, FSB, Salem, IN ($188 million); State Bank of Herscher, Herscher, IL ($146 million); and Cornerstone Bank, Wilson, NC ($107 million).

The additions this month were The First State Bank, Barboursville, WV ($241 million); Calumet County Bank, Brillion, WI ($91 million); and State Bank of Nauvoo, Nauvoo, IL ($32 million).

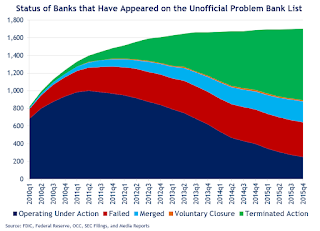

With it being the end of the fourth quarter, we bring an updated transition matrix to identify how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,701 institutions have appeared on a weekly or monthly list at some point. There have been 1,451 institutions that have transitioned through the list. Departure methods include 809 action terminations, 395 failures, 233 mergers, and 14 voluntary liquidations. The fourth quarter of 2015 started with 276 institutions on the list, so the 24 action terminations during the quarter reduced the list by 8.7 percent. Of the 389 institutions on the first published list, 28 or 7.2 percent still remain more than six years later. The 395 failures represent 23.2 percent of the 1,701 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 161 | (61,047,816) | |

| Unassisted Merger | 39 | (9,713,878) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (2,684,126) | ||

| Still on List at 12/31/2015 | 28 | 7,480,046 | |

| Additions after 8/7/2009 | 222 | 67,491,915 | |

| End (12/31//2015) | 250 | 74,971,961 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 648 | 265,149,840 | |

| Unassisted Merger | 194 | 78,301,665 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 238 | 119,574,853 | |

| Total | 1,090 | 465,350,500 | |

| 1Institution not on 8/7/2009 or 12/31/2015 list but appeared on a weekly list. | |||