by Calculated Risk on 1/03/2016 12:41:00 PM

Sunday, January 03, 2016

Question #6 for 2016: Will real wages increase in 2016?

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

6) Real Wage Growth: Last year I was one of the most pessimistic forecasters on wage growth. That was unfortunately correct (on nominal wages). Hopefully 2016 will be better for wages! How much will wages increase in 2016?

Note: Last year I was correct on nominal wages, but real wages increased (because of falling oil prices).

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up significantly last year. Sustained 2% real wage growth would be great, but most of the recent increase in real wages was due to falling oil prices - and that is not sustainable.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

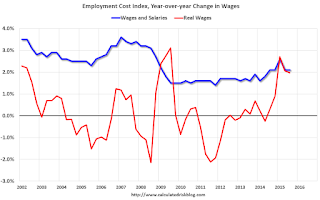

The second graph shows the year-over-year change using the quarterly wage data from the Employment Cost Index (data starts in 2001). Once again this shows nominal wages have increasing a little over 2% in 2015, and real wages increased (due to lower oil prices).

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?