by Calculated Risk on 3/04/2016 01:00:00 PM

Friday, March 04, 2016

Comments: A Strong Employment Report

This was a strong employment report.

The unemployment rate was unchanged at 4.9% even as the participation rate increased (another strong household survey). Not only was the headline number above the consensus forecast, but revisions were up for the previous two months. This was strong job growth.

Earlier: February Employment Report: 242,000 Jobs, 4.9% Unemployment Rate

A few more numbers: Total employment is now 5.1 million above the previous peak. Total employment is up 13.8 million from the employment recession low.

Private payroll employment increased 230,000 in February, and private employment is now 5.5 million above the previous peak. Private employment is up 14.3 million from the recession low.

In February, the year-over-year change was 2.67 million jobs.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in February to 81.2%, and the 25 to 54 employment population ratio increased to 77.8%. The participation rate for this group might increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.2% YoY in February. This series is noisy, however overall wage growth is trending up.

Note: CPI has been running under 2%, so there has been real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (also referred to as involuntary part-time workers) was unchanged in February at 6.0 million and has shown little movement since November. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons was little changed in February. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 9.7% in February - the lowest level since May 2008.

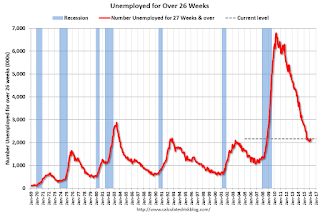

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.165 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 2.089 million in January.

This is generally trending down, but is still high.

There are still signs of slack (as example, part time workers for economic reasons and elevated U-6), but there also signs the labor market is tightening. Overall this was a strong employment report.