by Calculated Risk on 6/03/2016 09:41:00 AM

Friday, June 03, 2016

Comments: A Disappointing Employment Report

The headline jobs number was very disappointing, and there were downward revisions to job growth for prior months. The key negatives were few jobs added (only 38 thousand, although the Verizon strike cut the job growth by about 37 thousand), a decline in the participation rate, and a sharp increase in the number of people working part time for economic reasons.

A few positives include wage growth, a lower unemployment rate (however, for the wrong reason - a lower participation rate), and fewer long term unemployed.

Earlier: May Employment Report: 38,000 Jobs, 4.7% Unemployment Rate

In May, the year-over-year change was 2.40 million jobs.

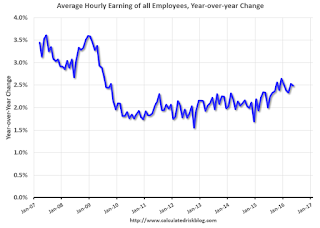

Average Hourly Earnings

On a monthly basis, wages increased at a 2.4% annual rate in May, and April was revised up.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in May. This series is noisy, however overall wage growth is trending up.

Note: CPI has been running under 2%, so there has been real wage growth.

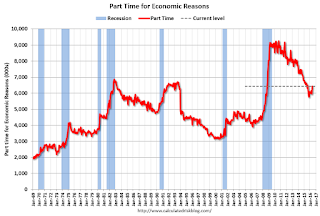

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (also referred to as involuntary part-time workers) increased by 468,000 to 6.4 million in May, after showing little movement since November. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased sharply in May. This level suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 9.7% in May.

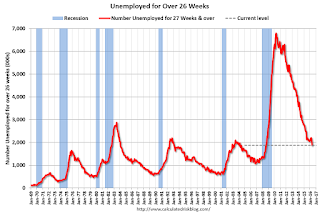

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.885 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.063 million in April, and the lowest since July 2008.

This is generally trending down, but is still high.

There are still signs of slack (as example, part time workers for economic reasons increase sharply, and elevated U-6), but there also signs the labor market is tightening (decline in long term unemployed, slight pickup in wages).

Overall this was a disappointing report.