by Calculated Risk on 9/28/2016 03:34:00 PM

Wednesday, September 28, 2016

OPEC Agrees to Cut Oil Output

From Bloomberg: OPEC Agrees to First Oil Output Cut in Eight Years

In two days of round-the-clock talks in Algiers, the group agreed to drop production to 32.5 million barrels a day, the delegate said, asking not to be named because the decision isn’t yet public. That’s nearly 750,000 barrels a day less than it pumped in August.

...

As OPEC agreed to limit its output, Russia smashed a post-Soviet oil-supply record, pumping 11.1 million barrels a day in September, up 400,000 from August, according to preliminary estimates. Russia participated in the Algiers talks, but it’s not party to the OPEC deal.

Click on graph for larger image

Click on graph for larger imageThis graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Brent and WTI oil prices are now up about 5% year-over-year.

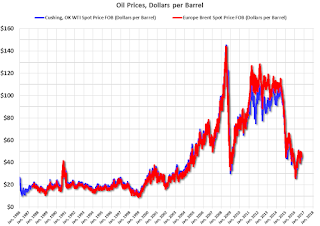

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $46.83 per barrel today, and Brent is at $48.41.

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Who knows if this agreement will hold, but it seems likely that oil prices - and eventually gasoline prices - will be up year-over-year at the end of 2016 and no longer a drag on CPI.