by Calculated Risk on 11/26/2016 08:11:00 AM

Saturday, November 26, 2016

Schedule for Week of Nov 27, 2016

The key report this week is the November employment report on Friday.

Other key indicators include October Personal Income and Outlays, November ISM manufacturing index, Case-Shiller house prices and November auto sales.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed surveys for October.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2016 (Second estimate). The consensus is that real GDP increased 3.1% annualized in Q3, revised from 2.9% in the advance report.

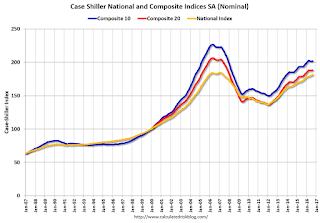

9:00 AM ET: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2016 report (the Composite 20 was started in January 2000).

The consensus is for a 5.2% year-over-year increase in the Comp 20 index for September. The Zillow forecast is for the National Index to increase 5.4% year-over-year in September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in November, up from 147,000 added in October.

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 52.0, up from 50.6 in October.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 0.8% increase in the index.

11:00 AM: The New York Fed will release their Q3 2016 Household Debt and Credit Report

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, up from 251 thousand the previous week.

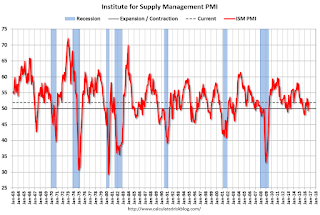

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.9% in October. The employment index was at 52.9%, and the new orders index was at 52.1%.

10:00 AM: Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

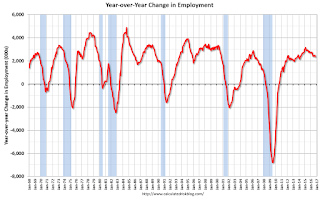

8:30 AM: Employment Report for November. The consensus is for an increase of 170,000 non-farm payroll jobs added in November, up from the 161,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to be unchanged at 4.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.36 million jobs.

A key will be the change in wages.