by Calculated Risk on 2/22/2017 05:35:00 PM

Wednesday, February 22, 2017

A Few Comments on January Existing Home Sales

Earlier: NAR: "Existing-Home Sales Jump in January"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus.

2) The contracts for most of the January existing home sales were entered after the recent increase in mortgage rates (rates started increasing after the election).

With the recent increase in rates, I'd expect some decline in sales volume as happened following the "taper tantrum" in 2013. So far that hasn't happened.

3) Inventory is still very low and falling year-over-year (down 7.1% year-over-year in January). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I expect inventory will be increasing year-over-year by the end of 2017.

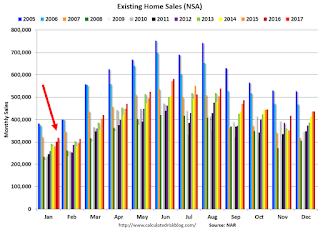

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in January (red column) were the highest for January since 2007 (NSA).

Note that sales NSA are in the slow seasonal period, and will increase sharply (NSA) in March.