by Calculated Risk on 3/28/2017 12:41:00 PM

Tuesday, March 28, 2017

Real House Prices and Price-to-Rent Ratio in January

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.9% year-over-year in January

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 1.9% above the previous bubble peak. However, in real terms, the National index (SA) is still about 14.5% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In January, the index was up 5.9% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

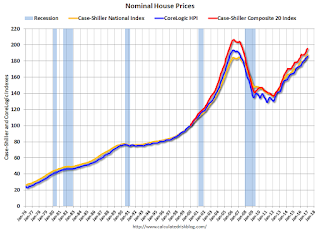

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to September 2005 levels, and the CoreLogic index (NSA) is back to September 2005.

Real House Prices

In real terms, the National index is back to April 2004 levels, the Composite 20 index is back to December 2003, and the CoreLogic index back to March 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

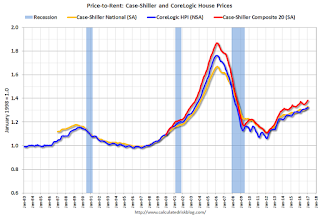

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, the Composite 20 index is back to August 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 / early 2004 - and the price-to-rent ratio maybe moving a little more sideways now.