by Calculated Risk on 4/03/2017 08:01:00 AM

Monday, April 03, 2017

Black Knight on Mortgages "44 Percent of Q4 Refis Were Cash-Outs, Most Equity Drawn in Eight Years"

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for February today. According to BKFS, 4.21% of mortgages were delinquent in February, down from 4.45% in February 2016. BKFS also reported that 0.93% of mortgages were in the foreclosure process, down from 1.30% a year ago.

This gives a total of 5.14% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Tappable Equity Hit $4.7 Trillion in 2016, Highest Since 2006; 44 Percent of Q4 Refis Were Cash-Outs, Most Equity Drawn in Eight Years

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of February 2017. This month, Black Knight revisited the equity landscape, finding that continued annual home price appreciation at the national level has helped to both further drive down the number of underwater borrowers and increase the level of tappable, or lendable, equity available to homeowners with a mortgage. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, today’s equity landscape – in conjunction with a higher interest rate environment – will likely impact mortgage lending trends over the coming year.

“December 2016 marked 56 consecutive months of annual home price appreciation,” said Graboske. “That served to not only lift an additional one million formerly underwater homeowners back into positive equity throughout the year, but also increased the amount of tappable equity available to U.S. mortgage holders by an additional $568 billion. There are now 39.5 million homeowners with tappable equity, meaning they have current combined loan-to-value (CLTV) ratios of less than 80 percent. Cash-out refinance data suggests that they have been increasingly tapping that equity, though perhaps more conservatively than homeowners had in the past. In Q4 2016, $31 billion in equity was extracted from the market via first lien refinances. While that was the most equity drawn in over eight years, borrowers are still tapping equity at less than a third of the rate they were back in 2005, and they’re doing so more prudently. In fact, the resulting post-cash-out loan-to-value-ratio was 65.6 percent, the lowest on record.

“However, it’s important to remember that we’ve also seen prepayment speeds – which are historically a good indicator of refinance activity – decline by nearly 40 percent since the start of 2017 in the face of today’s higher interest rate environment. Given the fact that nearly 70 percent of tappable equity belongs to borrowers with current interest rates below today’s prevailing 30-year interest rate, the incentive for many of these borrowers is shifting away from tapping equity via a first lien refinance and instead to home equity lines of credit. The last time interest rates rose as much as they have over the past few months, we saw cash-out refinances decline by 50 percent, but rate-term refinances decline by 75 percent. Based on past behavior, we may see a decline in first lien cash-out refinance volume, but it’s still likely that cash-out refinances – and purchase loans – will drive the lion’s share of prepayment activity over the coming year in any case. That’s why it’s so critical that those in the industry ensure that their prepayment models account for refinancing not just in terms of rate/term incentive, but also equity incentive as well. Additionally, prepayment models will need a stronger focus on housing turnover as purchase transactions become a larger fraction of total prepayments.”

emphasis added

Click on graph for larger image.

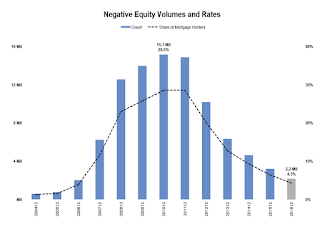

Click on graph for larger image.This graph from Black Knight shows the number and percent of properties with negative equity.

From Black Knight:

• December 2016 marked 56 consecutive months of annual home price appreciation, with home prices rising 5.5 percent over the course of the year

• An additional one million formerly underwater homeowners moved back into positive equity by year’s end, reducing the total negative equity population by 33 percent

• There are now 2.2 million homeowners remaining who owe more on their mortgages than their homes are worth, representing 4.3 percent of borrowers with a mortgage

This graph from Black Knight shows their estimate of "tappable equity".

This graph from Black Knight shows their estimate of "tappable equity".From Black Knight:

• Tappable (i.e., lendable) equity increased by nearly $570 billion in 2016, bringing total tappable equity to $4.7 trillion, the highest level seen since 2006There is much more in the mortgage monitor.

• There are now 39.5 million borrowers with tappable equity – meaning they have current combined loanto-value (CLTV) ratios of less than 80 percent – an increase of 2.6 million from one year ago

• 27 million of these borrowers have credit scores of 720 or higher, and between them they carry 78 percent of the nation’s tappable equity

• To put that in perspective: there are only 2.8 million borrowers that make for traditional refinance candidates (75BPS of rate incentive, 20 percent equity, 720 credit score or higher)