by Calculated Risk on 4/27/2017 11:00:00 AM

Thursday, April 27, 2017

Kansas City Fed: Regional Manufacturing Activity "Expanded at Slow Pace" in April

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Slower Pace

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slower pace with solid expectations for future activity.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding again.

“We came down a bit from the rapid growth rate of the past two months,” said Wilkerson. “But firms still reported a good increase in activity and expected this to continue.”

...

The month-over-month composite index was 7 in April, down from the very strong readings of 20 in March and 14 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity in both durable and nondurable goods plants eased slightly, particularly for metals, machinery, food, and plastic products. Most month-over-month indexes expanded at a slower pace in April. The production, shipments, and new orders indexes fell but remained positive, and the employment index edged lower from 13 to 9. In contrast, the new orders for exports index increased from 2 to 4. Both inventory indexes fell moderately after rising the past two months.

emphasis added

This was the last of the regional Fed surveys for April.

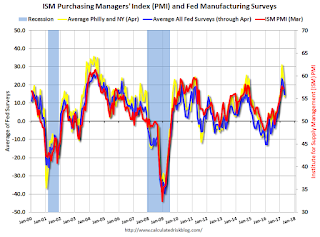

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

It seems likely the ISM manufacturing index will decline in April, but still show solid expansion (to be released next week).