by Calculated Risk on 7/26/2017 11:30:00 AM

Wednesday, July 26, 2017

A few Comments on June New Home Sales

New home sales for June were reported at 610,000 on a seasonally adjusted annual rate basis (SAAR). This was close to the consensus forecast, however the three previous months were revised down. Still, overall, this was a decent report.

Sales were up 9.1% year-over-year in June.

Earlier: New Home Sales increase to 610,000 Annual Rate in June.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 9.1% year-over-year in June.

For the first six months of 2017, new home sales are up 10.9% compared to the same period in 2016.

This was a strong year-over-year increase through June, however sales were weak in Q1 last year, so this was a somewhat easy comparison.

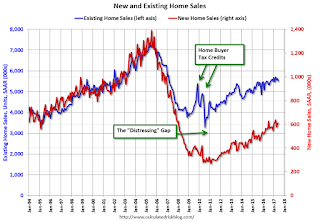

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.