by Calculated Risk on 11/09/2017 10:22:00 AM

Thursday, November 09, 2017

Is the stock market a bubble?

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

Over a week ago I posted five economic questions I'm frequently asked.

Last week I discussed: Are house prices in a new bubble? and Is a recession imminent (within the next 12 months)?

Here are a few thoughts on "Is the stock market a bubble?"

First, as long term readers know, I rarely comment directly on the stock market (although I did post on the market in 2009 since that was a turning point). I'll be brief here.

Second, I write about the economy, and the stock market is not the economy. This is usually my first comment to people when they ask about the market. However - in general - the stock market does well when the economy is expanding, and poorly during economic downturns.

There are exceptions: in 1987, the economy was fine, but the stock market crashed in October 1987. However the crash followed a very strong rally of over 30% from the beginning of 1987, and the market actually finished up for the year (although well off the peak). There were reasons for the crash - like portfolio insurance - that exacerbated the sell-off. In addition, there weren't any trading curbs (aka circuit breakers) in 1987, so the market could fall over 20% in one day.

Note: Some people say the 1987 proposed changes in the tax law - and a new Fed Chair - contributed to the 1987 crash. Echoes of history?

Third, the general rule is don't invest based on your political views. Those who sold, or didn't buy, because they didn't like Obama missed an historical rally. And those who sold, or didn't buy, because they don't like Trump missed solid gains this year.

Since I don't think a recession is imminent, I'd generally expect further gains in the market over the next year. The PE ratio is high (around 25), and that is well above average. However it is typical for the PE ratio to expand during an economic expansion.

As I noted in the Are house prices in a new bubble?, a bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value (like the PE ratio), but the real key for detecting a bubble is speculation. Back in the late '90s, stock speculation was obvious. Not only was margin debt high, but everyone was talking about investing in stocks - especially tech stocks. I knew the bubble was over when my mom called me and asked what "QQQ" stood for (NASDAQ ETF)? All her friends were buying it! (My shoeshine boy story).

Another possible indicator of speculation is margin debt.

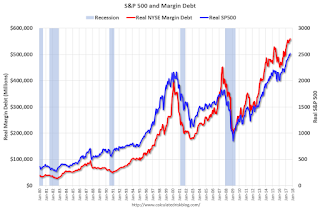

This graph shows the real S&P 500 (inflation adjusted, right axis), and real NYSE margin debt (left axis).

The high level of margin debt might suggest too much leverage.

The bottom line is the U.S. economy is doing well (the global economy is doing well too). There might be some speculation with margin debt, but everyone isn't talking stocks (like in 1999). So, in general, I don't think this is a bubble. Of course, as always, we could see a 10% to 20% correction starting at any time. I'll now go back to avoiding discussing the stock market.