by Calculated Risk on 12/28/2017 11:03:00 AM

Thursday, December 28, 2017

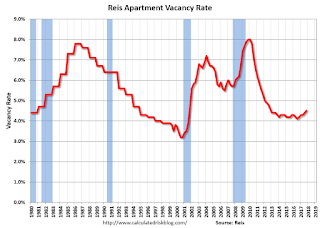

Reis: Apartment Vacancy Rate increased in Q4 to 4.5%

Reis reported that the apartment vacancy rate was at 4.5% in Q4 2017, up from 4.4% in Q3, and up from 4.2% in Q4 2016. This is the highest vacancy rate since Q4 2012 (although the increase has been small). The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

The apartment market continued to face pressure from added supply in the fourth quarter as the national vacancy rate increased 10 basis points to 4.5% in the quarter. Asking rents increased 0.4% in the fourth quarter, while effective rents grew 0.3%. Effective rents net out landlord concessions. Over the year, asking rents increased 3.9% while effective rents grew by 3.3%. These growth rates reflect a deceleration in apartment market fundamentals compared to recent years, due in part to the large amount of new supply coming online. New construction totaled 43,769 units in the fourth quarter, raising the year-end total to 213,802 units. The national apartment market has not seen new completions in excess of 200,000 since 1986.

At 4.5%, the national vacancy rate increased 10 basis points from 4.4% in the third quarter. This represents a 30 basis point increase in year-over-year vacancy (the year-end vacancy rate in 2016 was 4.2%); vacancies have more or less been on an upward march since the middle of 2016. The net change in occupied stock, or net absorption, was 31,554 units, lower than new supply. With supply growth outstripping demand, vacancies were pushed upwards this quarter.

At $1,364, the average asking rent grew 0.4% in the quarter. This is well below the 0.9% average quarterly growth rate for the prior six quarters. Effective rent growth was 0.3% in the quarter, also below the 0.8% average quarterly effective rent growth for the prior six quarters. Overall, these statistics reflect a distinct pullback in the national apartment market, especially when compared to 2015. However, the gap between asking rent growth and effective rent growth remained within a 10 basis point range. This suggests that landlords’ offers of free rent were less aggressive – implying that demand remains relatively robust.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However it appears the vacancy rate has bottomed and is starting to increase. With more supply coming on line next year - and less favorable demographics - the vacancy rate will probably continue to increase in 2018.

Apartment vacancy data courtesy of Reis.