by Calculated Risk on 1/30/2018 09:12:00 AM

Tuesday, January 30, 2018

Case-Shiller: National House Price Index increased 6.2% year-over-year in November

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Cities in the West: Seattle, Las Vegas and San Francisco Lead Gains in S&P Corelogic Case-Shiller Home Price Indices

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in November, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.1%, up from 5.9% the previous month. The 20-City Composite posted a 6.4% year-over-year gain, up from 6.3% the previous month.

Seattle, Las Vegas, and San Francisco reported the highest year-over-year gains among the 20 cities. In November, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with a 10.6% increase, and San Francisco with a 9.1% increase. Six cities reported greater price increases in the year ending November 2017 versus the year ending October 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in November. The 10-City and 20-City Composites reported increases of 0.3% and 0.2%, respectively. After seasonal adjustment, the National Index recorded a 0.7% month-over-month increase in November. The 10-City and 20-City Composites posted 0.8% and 0.7% month-over-month increases, respectively. Ten of 20 cities reported increases in November before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continue to rise three times faster than the rate of inflation,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index year-over-year increases have been 5% or more for 16 months; the 20-City index has climbed at this pace for 28 months. Given slow population and income growth since the financial crisis, demand is not the primary factor in rising home prices. Construction costs, as measured by National Income and Product Accounts, recovered after the financial crisis, increasing between 2% and 4% annually, but do not explain all of the home price gains. From 2010 to the latest month of data, the construction of single family homes slowed, with single family home starts averaging 632,000 annually. This is less than the annual rate during the 2007-2009 financial crisis of 698,000, which is far less than the long-term average of slightly more than one million annually from 1959 to 2000 and 1.5 million during the 2001-2006 boom years. Without more supply, home prices may continue to substantially outpace inflation.”

“Looking across the 20 cities covered here, those that enjoyed the fastest price increases before the 2007-2009 financial crisis are again among those cities experiencing the largest gains. San Diego, Los Angeles, Miami and Las Vegas, price leaders in the boom before the crisis, are again seeing strong price gains. They have been joined by three cities where prices were above average during the financial crisis and continue to rise rapidly – Dallas, Portland OR, and Seattle.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 3.6% from the peak, and up 0.8% in November (SA).

The Composite 20 index is off slightly from the peak, and up 0.8% (SA) in November.

The National index is 6.4% above the bubble peak (SA), and up 0.7% (SA) in November. The National index is up 43.8% from the post-bubble low set in December 2011 (SA).

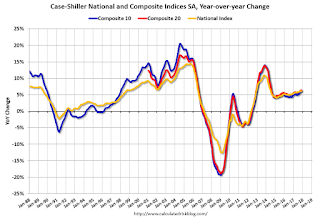

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.1% compared to November 2016. The Composite 20 SA is up 6.4% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.