by Calculated Risk on 3/13/2019 11:46:00 AM

Wednesday, March 13, 2019

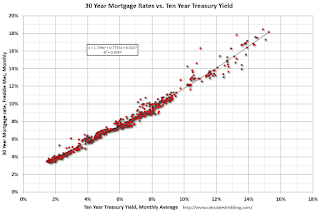

Mortgage Rates and Ten Year Yield

With the ten year yield falling to 2.6%, and based on an historical relationship, 30-year rates should currently be around 4.4%.

As of yesterday, Mortgage News Daily reported: Mortgage Rates Drop to New 14-Month Lows

Mortgage rates dropped convincingly today, bringing them to new long-term lows. The average lender hasn't offered anything lower for more than a year (January 2018). The improvement came on a combination of news headlines, economic data, and the scheduled sale of US 10yr Treasury debt. [30YR FIXED - 4.375% - 4.5%]The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

emphasis added

Currently the 10 year Treasury yield is at 2.62%, and 30 year mortgage rates were at 4.41% according to the Freddie Mac survey last week.

Currently the 10 year Treasury yield is at 2.62%, and 30 year mortgage rates were at 4.41% according to the Freddie Mac survey last week.To fall to 4% on the Freddie Mac survey, and based on the historical relationship, the Ten Year yield would have to fall to around 2.1%

To increase to 5% (on the Freddie Mac survey), based on the historical relationship, the Ten Year yield would have to increase to about 3.3%.