by Calculated Risk on 5/15/2019 07:00:00 AM

Wednesday, May 15, 2019

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 10, 2019.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

“Purchase applications declined slightly last week but still remained almost 7 percent higher than a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the third straight decline in mortgage rates, refinance applications decreased for the fifth time in six weeks, albeit by less than 1 percent.”

Added Kan, “It’s worth watching if ongoing global trade disputes lead to increased anxiety about the economy, which could cause some potential homebuyers to put off their home search until the uncertainty is resolved.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.40 percent from 4.41 percent, with points decreasing to 0.40 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

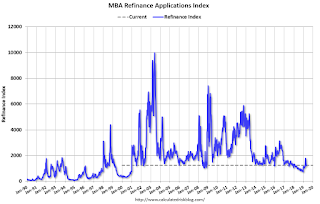

Click on graph for larger image.The first graph shows the refinance index since 1990.

Once mortgage rates fell more than 50 bps from the highs of last year, a number of recent buyers were able to refinance. But it would take another significant decrease in rates to see a further increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 7% year-over-year.