by Calculated Risk on 9/09/2019 10:28:00 AM

Monday, September 09, 2019

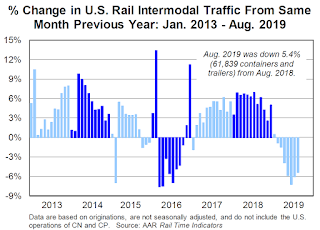

AAR: August Rail Carloads down 4.6% YoY, Intermodal Down 5.4% YoY

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

It seems clear that U.S. railroads are facing a freight recession. Total originated U.S. rail carloads fell 4.6% in August 2019 from August 2018, their seventh straight year-over-year decline. The average decline over those seven months was 4.2%, a not-insignificant amount. Meanwhile, U.S. intermodal volume fell 5.4% in August, also the seventh straight monthly decline. … Why? The parts of the economy that generate much of the freight that railroads carry — manufacturing and goods trading — have weakened significantly over the past several months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the year-over-year changes in U.S. Carloads.

U.S. railroads originated 1.06 million total carloads in August 2019, down 4.6%, or 50,672 carloads, from August 2018. August was the seventh straight year-over-year decline. For the first eight months of 2019, total U.S. carloads were down 3.4%, or 310,246 carloads, compared with 2018. Our U.S. data begin in 1988. Since then, only 2016 had fewer year-to-date total carloads than this year.

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):For intermodal, August was no prize either: originations were down 5.4% from August 2018. That too was the seventh straight decline. In 2019 through August, intermodal originations were down 3.9%, or 375,964 containers and trailers, from last year. It’s some consolation, though, that 2018 was a record year for intermodal, and this year’s January-August total is the second best ever (behind 2018).

So far, U.S. rail traffic appears to be mirroring what happened in late 2015 and 2016, when it fell for 13 out of 14 months. Back then, there was a freight recession, but not an economywide recession. We appear to be in another freight recession now. Whether the same thing happens this time around — the overall economy wobbles but doesn’t fall down1 — remains to be seen, but railroads are already suffering. One reason why is that the ongoing trade war and accompanying uncertainty has had the most direct impact on manufacturing and commodity-related industries that are heavily served by railroads but that comprise only a moderate share of the overall economy.