by Calculated Risk on 11/04/2019 09:27:00 AM

Monday, November 04, 2019

Black Knight Mortgage Monitor for September: "Early-Stage Delinquencies Continue to Rise Among Purchase Loans"

CR Note: Early-stage delinquencies are still historically very low, but have been increasing (see second graph).

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 3.53% of mortgages were delinquent in September, down from 3.97% in September 2018. Black Knight also reported that 0.48% of mortgages were in the foreclosure process, down from 0.52% a year ago.

This gives a total of 4.05% delinquent or in foreclosure.

Press Release: Black Knight’s September 2019 Mortgage Monitor: First-Time Homebuyers Under Pressure as Early-Stage Delinquencies Continue to Rise Among Purchase Loans

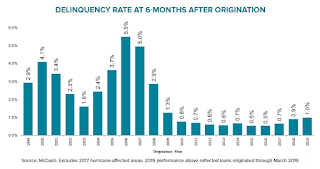

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, Black Knight looked at the current trend of rising early-stage delinquencies, particularly among purchase loans. As Black Knight Data & Analytics President Ben Graboske explained, the number of loans that were delinquent six months following origination has been increasing over the past 24 months, with first-time homebuyers being impacted most heavily.

“We’ve seen early-stage delinquencies rise over the last several years, with the increase being driven primarily by purchase loans,” said Graboske. “About 1% of loans originated in Q1 2019 were delinquent six months after origination. While that’s less than one-third of the 2000-2005 average of 2.95%, it represents a more than 60% increase over the last two years and is the highest it’s been since late 2010. Early-stage GSE delinquencies currently stand at 0.6%, up two tenths of a percentage point over the past 24 months, but still 40% below the market average and 60% below their own 2000-2005 average of 1.3%. Though there has been some softening in GSE purchase loan performance, it hasn’t been to the extent seen among entry-level buyers. All in all, first-time homebuyer originations combined between the GSEs and GNMA increased by nearly 50% between 2014 and 2018. However, whereas first-time homebuyers represent just over 40% of GSE purchase loans, they make up 70% of the GNMA purchase market.

“That concentration is contributing to a more significant increase in early-stage delinquencies among GNMA loans, which saw 3.3% of loans delinquent six months after origination. That’s up 1.2 percentage points from two years ago, and though still roughly half the 2000-2005 pre-crisis average, it represents the sharpest increase we’ve seen in the market in recent years. However, performance among repeat purchasers with GNMA-securitized loans has remained relatively steady overall, with the rise more pronounced among first-time homebuyers. Rising debt-to-income ratios due to tight affordability and declining first-time homebuyer credit scores stand out as likely drivers here. With a growing population of first-time homebuyers poised to enter the market, this is a trend Black Knight will continue to monitor.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the Foreclosure Sales over time.

From Black Knight:

• Foreclosure sales (completions) are down 14% year-over-year, and have now set new record lows in each of the past five quartersThe second graph shows early stage delinquencies:

• The 35.7K foreclosure sales in Q3 are nearly 50% below the pre-recession (2000-2005) average

• Florida, New York and Illinois led all states with 3.2K, 2.5K and 2.4K foreclosure completions respectively in Q3

• Despite having the largest number of foreclosure sales, Florida's sale activity declined by 19% from the year prior, while in New York, sales actually edged slightly upward year-over-year (+4% Y/Y)

• Early-stage delinquencies among recent originations continue to trend upwardThere is much more in the mortgage monitor.

• Nearly 1% of Q1 2019 originations were delinquent six months post-origination; though less than a third of 2000-2005 average of 2.93%, that’s up more than 60% over the past 24 months and the highest since 2010

• This increase has primarily been driven by a rise in early-stage delinquencies among purchase loans, and to a lesser degree by cash-out refinances

• While performance of rate/term refinances has remained relatively flat, early-stage delinquencies among cash-out refis – though lower than the market as a whole – have also moved upward in recent years

• Should the rise in delinquencies among more recent originations continue, we may ultimately see an increase in overall delinquency rates