by Calculated Risk on 1/28/2020 09:06:00 AM

Tuesday, January 28, 2020

Case-Shiller: National House Price Index increased 3.5% year-over-year in November

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Index Continues Upward Trend for Annual Home Price Gains

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.5% annual gain in November, up from 3.2% in the previous month. The 10-City Composite annual increase came in at 2.0%, up from 1.7% in the previous month. The 20-City Composite posted a 2.6% year-over-year gain, up from 2.2% in the previous month.

Phoenix, Charlotte and Tampa reported the highest year-over-year gains among the 20 cities. In November, Phoenix led the way with a 5.9% year-over-year price increase, followed by Charlotte with a 5.2% increase and Tampa with a 5.0% increase. Fifteen of the 20 cities reported greater price increases in the year ending November 2019 versus the year ending October 2019.

...

The National Index posted a month-over-month increase of 0.2%, while the 10-City and 20-City Composites both posted a month-over-month increase of 0.1% before seasonal adjustment in November. After seasonal adjustment, the National Index, 10-City and 20-City Composites all posted a 0.5% increase. In November, 13 of 20 cities reported increases before seasonal adjustment while all 20 cities reported increases after seasonal adjustment.

"The U.S. housing market was stable in November,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “With the month’s 3.5% increase in the national composite index, home prices are currently 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. November’s results were broad-based, with gains in every city in our 20-city composite.

“At a regional level, Phoenix retains the top spot for the sixth consecutive month, with a gain of 5.9% for November. Charlotte and Tampa rose by 5.2% and 5.0% respectively, leading the Southeast region. The Southeast has led all regions since January 2019.”

“As was the case last month, after a long period of decelerating price increases, the National, 10-city, and 20-city Composites all rose at a modestly faster rate in November than they had done in October. This increase was broad-based, reflecting data in 15 of 20 cities. It is, of course, still too soon to say whether this marks an end to the deceleration or is merely a pause in the longer-term trend.”

emphasis added

Click on graph for larger image.

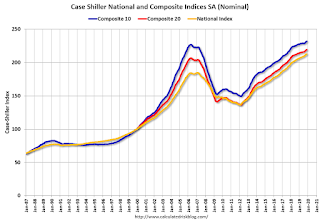

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 2.2% from the bubble peak, and up 0.5% in November (SA) from September.

The Composite 20 index is 6.1% above the bubble peak, and up 0.5% (SA) in November.

The National index is 15.3% above the bubble peak (SA), and up 0.5% (SA) in November. The National index is up 55.9% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.0% compared to November 2018. The Composite 20 SA is up 2.5% year-over-year.

The National index SA is up 3.5% year-over-year.

Note: According to the data, prices increased in 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.