by Calculated Risk on 4/29/2020 11:55:00 AM

Wednesday, April 29, 2020

Q1 GDP: Investment

Investment has been weak for some time, and most investment categories were even weaker in Q1 due to COVID-19. However residential investment was very strong in Q1 (increased at 21.0% annual rate in Q1).

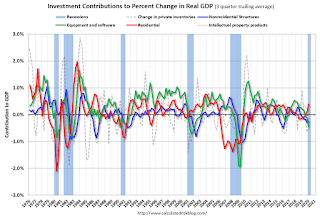

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased in Q1 (21.0% annual rate in Q1). Equipment investment decreased at a 15.2% annual rate, and investment in non-residential structures decreased at a 9.7% annual rate.

On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is negative, and nonresidential structures (blue) is also down.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q1. RI as a percent of GDP is close to the bottom of the previous recessions - and prior to the pandemic, I expected RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.