by Calculated Risk on 7/27/2020 12:55:00 PM

Monday, July 27, 2020

Where to Look for Initial Economic Damage if Disaster Relief is Inadequate

The GOP is scheduled to release their proposed Disaster Relief plan this afternoon. Based on early reports, their proposed package will be grossly insufficient. However, there will be further negotiations with the House, and the eventual package might be somewhat adequate.

If the package is inadequate, I’d expect the initial negative impact to be on retail sales and housing. In addition, I’d expect to see significant state and local layoffs over the next few months.

Retail sales for August will not be released until September 16th, but there are several high frequency releases on housing that I’ll be tracking.

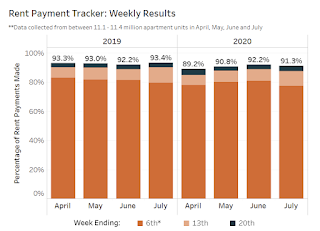

1). National Multifamily Housing Council (NMHC) Rent Tracker.

Click on graph for larger image.

The NMHC has been releasing this data at several points during the month.

Note that this is a "survey of 11.1 million units of professionally managed apartment units across the country". Smaller apartment owners are certainly performing worse.

We might see a significant decline in rents paid in August or September, especially if the extra Federal Unemployment benefit is cut substantially.

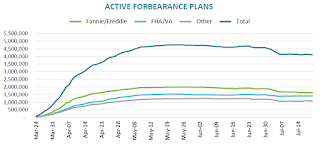

2) Weekly Forbearance Activity from the MBA and Black Knight.

This graph is from Black Knight.

There was a surge in forbearance activity in late March and early April, but the number of mortgages in forbearance have declined slightly.

If the Disaster Relief package is inadequate, we might see another increase in forbearance plans.

3) Weekly Census Household Pulse Survey.

The Household Pulse Survey is scheduled to end this week, on July 29th, but hopefully the survey will be extended.

This will be a key number to watch.

In addition, I'll be watching the High Frequency Indicators for the Economy that I've been posting every Monday.

Also, I’ll be looking for reports on credit card spending to get a hint about retail sales.