by Calculated Risk on 8/07/2020 09:16:00 AM

Friday, August 07, 2020

Comments on July Employment Report

The labor market swings have been huge, and the July employment report was somewhat better than expected with 1.8 million jobs added.

Leisure and hospitality led the way with 592 thousand jobs added in July, following 3.386 million jobs added in May and June. Leisure and hospitality lost 8.318 million jobs in March and April, so about 48% of those jobs were added back in May, June and July.

Earlier: July Employment Report: 1.8 Million Jobs Added, 10.2% Unemployment Rate

In July, the year-over-year employment change was minus 11.4 million jobs.

As expected, there were 27 thousand temporary Decennial Census workers hired (and included in this report). This will surge over the next two to three months. "A July job gain in federal government (+27,000) reflected the hiring of temporary workers for the 2020 Census."

State and local education declined 960 thousand in July NSA (Not Seasonally Adjusted). This was much more than expected, and this resulted an increase of only 245 thousand jobs SA (Seasonally Adjusted). This means state and local governments are cutting education much more than expected due to budget constraints. I'll have more on this later.

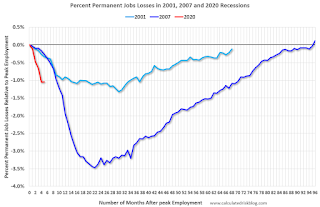

Permanent Job Losers

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the July report. (ht Joe Weisenthal at Bloomberg)

This data is only available back to 1994, so there is only data for three recessions.

In July, the number of permanent job losers was essentially unchanged from June.

Prime (25 to 54 Years Old) Participation

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate decreased in July to 81.3%, and the 25 to 54 employment population ratio increased slightly to 73.8%.

Part Time for Economic Reasons

"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 619,000 to 8.4 million in July, reflecting a decline in the number of people whose hours were cut due to slack work or business conditions (-658,000). The number of involuntary part-time workers is 4.1 million higher than in February."The number of persons working part time for economic reasons decreased in July to 8.443 million from 9.062 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 16.5% in July. This is down from the record high in April 22.8% for this measure since 1994. The previous peak was 17.2% during the Great Recession.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.501 million workers who have been unemployed for more than 26 weeks and still want a job. This will increase sharply in 2 or 3 months, and will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was above expectations and the previous two months were revised up 18,000 combined. The headline unemployment rate decreased to 10.2%.

As a reminder, the course of the economy will be determined by the course of the pandemic.