by Calculated Risk on 12/16/2020 10:59:00 AM

Wednesday, December 16, 2020

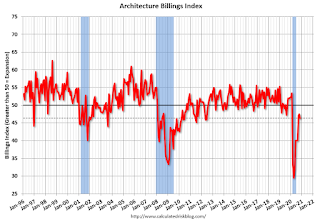

AIA: "Architecture billings lose ground in November"

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings lose ground in November

Architecture firm billing activity is contracting once again after two months of a slowing decline, according to a new report from the American Institute of Architects (AIA).

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5 (any score below 50 indicates a decline in firm billings). The pace of inquiries into new projects slowed, but remained positive with a score of 52.0, however the value of new design contracts dipped back into negative territory with a score 48.6.

“In previous design cycles, we typically haven’t seen a straight line back to growth after a downturn hits,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The path to recovery is shaping up to be bumpier than we hoped for. While there are pockets of optimism in design services demand, the overall construction landscape remains depressed.”

...

• Regional averages: Midwest (50.1); West (48.3); South (46.7); Northeast (38.7)

• Sector index breakdown: multi-family residential (52.2); mixed practice (49.5); commercial/industrial (47.5); institutional (41.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.3 in November, down from 47.5 in October. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for nine consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through most of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.