by Calculated Risk on 5/14/2021 05:19:00 PM

Friday, May 14, 2021

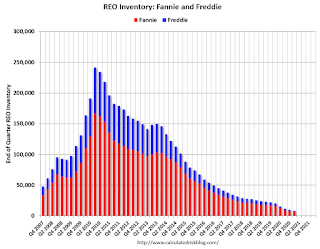

Fannie and Freddie: REO inventory declined in Q1, Down 58% Year-over-year

Fannie and Freddie earlier reported results two weeks ago for Q1 2021. Here is some information on Real Estate Owned (REOs).

Note that COVID is impacting foreclosure activity, from Freddie: "The volume of foreclosures declined significantly, year-over-year, primarily due to the foreclosure moratorium that will remain in effect through June 30, 2021." emphasis added

Freddie Mac reported the number of REO declined to 1,604 at the end of Q1 2021 compared to 4,168 at the end of Q1 2020.

For Freddie, this is down 98% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 6,918 at the end of Q1 2021 compared to 16,289 at the end of Q1 2020.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 2021, and combined inventory is down 58% year-over-year.

This is well below a normal level of REOs for Fannie and Freddie.

For Freddie, this is down 98% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 6,918 at the end of Q1 2021 compared to 16,289 at the end of Q1 2020.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 2021, and combined inventory is down 58% year-over-year.

This is well below a normal level of REOs for Fannie and Freddie.