by Calculated Risk on 7/12/2022 08:11:00 AM

Tuesday, July 12, 2022

Reis: Office Vacancy Rate Increased in Q2, Mall Vacancy Rate Unchanged

From Moody’s Analytics Senior Economist Lu Chen: Apartment sets new record, Office continued its bumpy ride, and Retail stayed flat

Given the intriguing supply and demand dynamics, office vacancy trended up 30 bps and finished the2nd quarter at 18.4%, merely 10 bps lower than its pandemic high in Q2 2021. On the rent front, both asking and effective rents edged up 0.4% during the quarter – these are the highest growth rates since the pandemic began. .

...

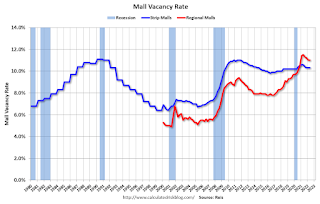

Our data shows the national vacancy for neighborhood and community shopping center has stayed flat at 10.3%, while asking rent is virtually unchanged and effective rent inched up 0.1% in the second quarter. Trend data on regional and super regional malls tells a similar story. Vacancy stayed flat at 11% and effective rent was up 0.1% this quarter.

emphasis added

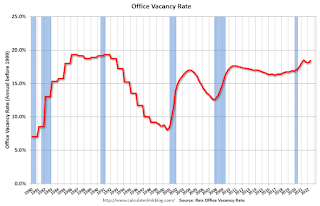

Reis reported the office vacancy rate was at 18.4% in Q2 2022, up from 18.1% in Q1, and down from 18.5% in Q2 2021.

Q2 2021 saw the highest vacancy rate for offices since the early '90s (following the S&L crisis)

NOTE: This says nothing about how many people are in the offices (related to the increase in work-from-home), just whether or not the office space is leased.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

The office vacancy rate was elevated prior to the pandemic and moved up during the pandemic.

Reis also reported that office effective rents were increased 0.4% in Q2; rents are about at the same as in early 2019.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q2, unchanged from 10.3% in Q1, and down from 10.6% in Q2 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis. In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Effective rents have been mostly unchanged for regional malls over the last 3 years, and flat for strip malls for 5+ years.

All vacancy data courtesy of Moody’s Analytics Reis