by Calculated Risk on 2/08/2023 07:00:00 AM

Wednesday, February 08, 2023

MBA: Mortgage Applications Increased in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 3, 2023.

... The Refinance Index increased 18 percent from the previous week and was 75 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 37 percent lower than the same week one year ago.

“Applications rose last week as the 30-year fixed mortgage rate inched lower to 6.18 percent, its fifth consecutive weekly decline. The 30-year fixed rate is almost a percentage point below its recent high of 7.16 percent in October 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Both purchase and refinance applications increased last week and have shown gains in three of the past four weeks because of lower rates. Overall applications remained 58 percent lower than a year ago and rates are still significantly higher, however, this week’s results are a step in the right direction. Purchase activity that was put on hold last year due to the quick runup in rates is gradually coming back as rates ease and housing demand remains strong, driven by supportive demographics and the ongoing strength in the job market.”

Added Kan, “The average loan size on a purchase application increased to $428,500 – the largest average since May 2022. This increase is a sign that the recent upward trend in purchase activity remains skewed toward larger loan sizes and less first-time homebuyer activity, as entry level housing remains undersupplied, and buyers struggle with affordability in many markets.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.18 percent from 6.19 percent, with points decreasing to 0.64 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

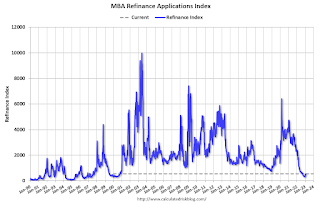

Click on graph for larger image.The first graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index declined sharply in 2022.

A month ago, the refinance index was at the lowest level since the year 2000, but it has rebounded a somewhat as rates declined.

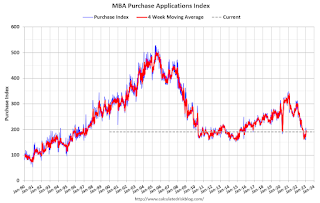

The second graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 37% year-over-year unadjusted. This has increased a little with lower rates, but is still near housing bust levels.

According to the MBA, purchase activity is down 37% year-over-year unadjusted. This has increased a little with lower rates, but is still near housing bust levels.

Note: Red is a four-week average (blue is weekly).