by Calculated Risk on 3/21/2023 10:11:00 AM

Tuesday, March 21, 2023

NAR: Existing-Home Sales Increased to 4.58 million SAAR in February

From the NAR: Existing-Home Sales Surged 14.5% in February, Ending 12-Month Streak of Declines

Existing-home sales reversed a 12-month slide in February, registering the largest monthly percentage increase since July 2020, according to the National Association of REALTORS®. Month-over-month sales rose in all four major U.S. regions. All regions posted year-over-year declines.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops – vaulted 14.5% from January to a seasonally adjusted annual rate of 4.58 million in February. Year-over-year, sales fell 22.6% (down from 5.92 million in February 2022).

...

Total housing inventory registered at the end of February was 980,000 units, identical to January and up 15.3% from one year ago (850,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, down 10.3% from January but up from 1.7 months in February 2022.

emphasis added

Click on graph for larger image.

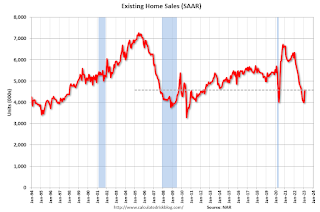

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (4.58 million SAAR) were up 14.5% from the previous month and were 22.6% below the February 2022 sales rate.

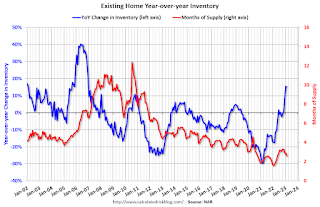

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was unchanged at 0.98 million in February from 0.98 million in January.

According to the NAR, inventory was unchanged at 0.98 million in February from 0.98 million in January.

According to the NAR, inventory was unchanged at 0.98 million in February from 0.98 million in January.

According to the NAR, inventory was unchanged at 0.98 million in February from 0.98 million in January.Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

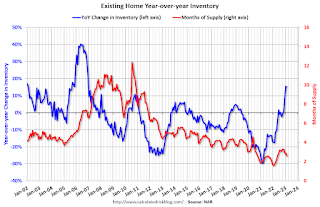

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 15.3% year-over-year (blue) in February compared to February 2022.

Inventory was up 15.3% year-over-year (blue) in February compared to February 2022.

Months of supply (red) declined to 2.6 months in February from 2.9 months in January.

This was well above the consensus forecast (but at Lawler's projection). I'll have more later.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 15.3% year-over-year (blue) in February compared to February 2022.

Inventory was up 15.3% year-over-year (blue) in February compared to February 2022. Months of supply (red) declined to 2.6 months in February from 2.9 months in January.

This was well above the consensus forecast (but at Lawler's projection). I'll have more later.