by Calculated Risk on 6/20/2023 04:00:00 PM

Tuesday, June 20, 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.49% in May"

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.49% in May

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.51% of servicers’ portfolio volume in the prior month to 0.49% as of May 31, 2023. According to MBA’s estimate, 245,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.9 million borrowers since March 2020.

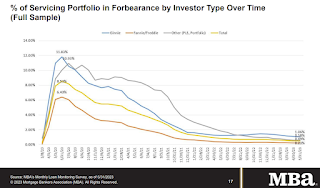

In May 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.23%. Ginnie Mae loans in forbearance decreased 5 basis points to 1.06%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 3 basis points to 0.58%.

“The number of loans in forbearance is reaching levels not seen since the beginning of March 2020, prior to the passage of the CARES Act,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Today, more than 96 percent of homeowners are current on their mortgages, thanks to the favorable jobs market and the success of loss mitigation options over the past three years.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing, declined to 0.49% in May from 0.51% in April.

At the end of May, there were about 245,000 homeowners in forbearance plans.

The second graph shows the percent of mortgages current by state.

The second graph shows the percent of mortgages current by state.From the MBA:

Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) increased to 96.12% in May 2023 from 95.89% in April 2023 (on a non-seasonally adjusted basis).

o The five states with the highest share of loans that were current as a percent of servicing portfolio: Washington, Idaho, Colorado, California, and Oregon.

o The five states with the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, West Virginia, New York, and Indiana.