by Calculated Risk on 6/30/2023 08:37:00 AM

Friday, June 30, 2023

Personal Income increased 0.4% in May; Spending increased 0.1%

The BEA released the Personal Income and Outlays report for May:

Personal income increased $91.2 billion (0.4 percent at a monthly rate) in May, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $86.7 billion (0.4 percent) and personal consumption expenditures (PCE) increased $18.9 billion (0.1 percent).The May PCE price index increased 3.8 percent year-over-year (YoY), down from 4.3 percent YoY in April, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI increased 0.3 percent in May and real PCE decreased by less than 0.1 percent; goods decreased 0.4 percent and services increased 0.2 percent

emphasis added

The PCE price index, excluding food and energy, increased 4.6 percent YoY, down from 4.7 percent in April, and down from the recent peak of 5.4 percent in February 2022.

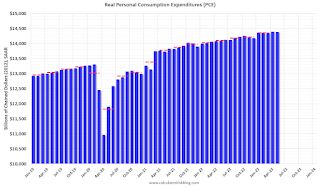

The following graph shows real Personal Consumption Expenditures (PCE) through May 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.

The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and PCE was slightly below expectations.

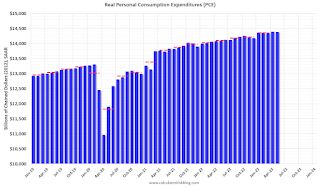

The following graph shows real Personal Consumption Expenditures (PCE) through May 2023 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and PCE was slightly below expectations.

Inflation was slightly below expectations.

Using the two-month method to estimate Q2 real PCE growth, real PCE was increasing at a 0.7% annual rate in Q2 2023. (Using the mid-month method, real PCE was increasing at 0.8%). This suggests weak PCE growth in Q2.