by Calculated Risk on 9/20/2023 11:46:00 AM

Wednesday, September 20, 2023

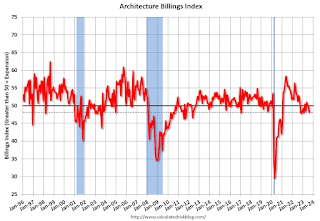

AIA: Architecture Billings "Softening Business Conditions in August"; Multi-family Billings Decline for 13th Consecutive Month

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Sees Softening Business Conditions in August

The AIA/Deltek Architecture Billings Index (ABI) eased modestly in August, with a score of 48.1, marking the eleventh consecutive month of essentially flat billings at architecture firms. Any score below 50.0 indicates decreasing business conditions. This follows a period of robust growth in 2021 and 2022. While inquiries into new projects remained relatively strong in August, the value of newly signed design contracts declined for the first time since April, indicating that fewer clients signed contracts for new projects than in the prior three months.

“Business conditions at architecture firms continue to be sluggish,” said Kermit Baker, PhD, AIA Chief Economist. “New project work coming into architecture firms as well ongoing project activity remain stalled in a relatively narrow range and exhibit very little month-to-month variation. Through this pause has taken pressure off tight staffing conditions across the profession, there is considerable uncertainty over the direction of future activity.”

Business conditions also remained soft at firms with a multifamily residential specialization and declined modestly at firms with an institutional specialization. However, firms with a commercial/industrial specialization reported billings growth for the third month in a row in August.

...

• Regional averages: Northeast (50.6); South (49.9); Midwest (48.1); West (45.8)

• Sector index breakdown: commercial/industrial (51.5); institutional (49.4); mixed practice (firms that do not have at least half of their billings in any one other category) (46.9); multifamily residential (44.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.1 in July, down from 50.0 in July. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment into 2024.

Note that multi-family billing turned down in August 2022 and has been negative for thirteen consecutive months (with revisions). This suggests we will see a further weakness in multi-family starts.