by Calculated Risk on 12/22/2023 03:20:00 PM

Friday, December 22, 2023

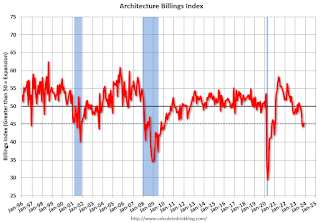

AIA: "Architecture firm billings continue to decline in November"; Multi-family Billings Decline for 16th Consecutive Month

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI November 2023: Business conditions remain soft at architecture firms

Business conditions remained soft at architecture firms in November, as the AIA/Deltek Architecture Billings Index (ABI) remained below 50 with a score of 45.3 for the month (any score below 50 indicates declining billings). The score increased by one point from October, indicating that slightly fewer firms reported a decline in billings in November, but the majority of firms continued to report weak business for the fourth consecutive month, and the seventh month so far this year. However, there are still some encouraging signs of potential work in the pipeline as inquiries bounced back in November after declining in October. And while the value of new signed design contracts continued to decrease in November, fewer firms reported a decline than in October.• Regional averages: Northeast (44.4); South (46.7); Midwest (49.0); West (39.5)

Billings also remained weak at firms around the country in November, with firms in all regions reporting a decline for the fourth consecutive month. Business conditions remained softest at firms located in the West, which has been the case since March. And firms of all specializations also reported declining billings this month, with conditions remaining weakest at firms with a multifamily residential specialization. Billings also continued to decline further at firms with an institutional specialization, which was the strongest sector earlier this year.

emphasis added

• Sector index breakdown: commercial/industrial (45.7); institutional (46.6); multifamily residential (42.1)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.3 in November, up from 44.3 in October. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

Note that multi-family billing turned down in August 2022 and has been negative for sixteen consecutive months (with revisions). This suggests we will see a further weakness in multi-family starts.