by Calculated Risk on 2/06/2024 11:00:00 AM

Tuesday, February 06, 2024

NY Fed Q4 Report: Household Debt Increased

From the NY Fed: Credit Card and Auto Loan Delinquencies Continue Rising; Notably Among Younger Borrowers

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $212 billion (1.2%) in the fourth quarter of 2023, to The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

The New York Fed also issued an accompanying Liberty Street Economics blog post examining the composition of auto loan balances and performance by age and income. The Quarterly Report also includes a one-page summary of key takeaways and their supporting data points.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.”

Mortgage balances rose by $112 billion from the previous quarter and stood at $12.25 trillion at the end of December. Balances on home equity lines of credit (HELOC) increased by $11 billion, the seventh consecutive quarterly increase after Q1 2022, and now stand at $360 billion. Credit card balances increased by $50 billion to $1.13 trillion. Auto loan balances rose by $12 billion, continuing the upward trajectory seen since 2020, and now stand at $1.61 trillion.

Mortgage originations continued at a similar pace as seen in the previous two quarters, and now stand at $394 billion. Aggregate limits on credit card accounts increased modestly by $74 billion, representing a 1.6% increase from the previous quarter. Limits on HELOC grew by $24 billion and have grown by 10% over the past two years, after 10 years of observed declines.

Aggregate delinquency rates increased in Q4 2023, with 3.1% of outstanding debt in some stage of delinquency at the end of December. Delinquency transition rates increased for all debt types, except for student loans. Annualized, approximately 8.5% of credit card balances and 7.7% of auto loans transitioned into delinquency. Delinquency transition rates for mortgages increased by 0.2 percentage points yet remain low by historic standards. Serious credit card delinquencies increased across all age groups, notably with younger borrowers surpassing pre-pandemic levels.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows household debt increased in Q4. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $212 billion in the fourth quarter of 2023, a 1.2% rise from 2023Q3. Balances now stand at $17.50 trillion and have increased by $3.4 trillion since the end of 2019, just before the pandemic recession.

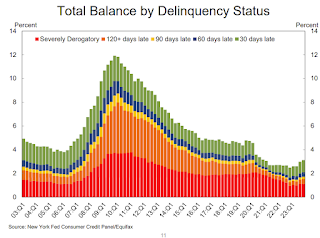

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q4. From the NY Fed:

Aggregate delinquency rates increased in the fourth quarter of 2023. As of December, 3.1% of outstanding debt was in some stage of delinquency, up by 0.1 percentage point from the third quarter. Still, overall delinquency rates remain 1.6 percentage points lower than the fourth quarter of 2019.

Delinquency transition rates increased for all product types, except for student loans. Annualized, approximately 8.5% of credit card balances and 7.7% of auto loan balances transitioned into delinquency. Early delinquency transition rates for mortgages increased by 0.2 percentage point yet remain low by historic standards.

About 114,000 consumers had a bankruptcy notation added to their credit reports in 2023Q4, slightly less than in the previous quarter. Approximately 4.7% of consumers have a 3rd party collection account on their credit report

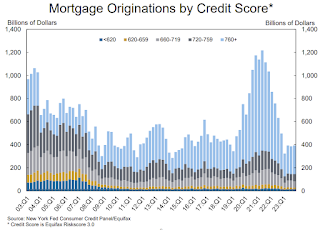

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, continued at the same pace observed in the previous two quarters, at $394 billion in 2023Q4, and well below the trillion-dollar-plus quarterly origination volumes observed between 2020Q2 and 2021Q4. ... Limits on home equity lines of credit (HELOC) grew by $24 billion, and have grown by 10% over the past two years after ten years of decreasesThere is much more in the report.