by Calculated Risk on 2/10/2024 08:11:00 AM

Saturday, February 10, 2024

Schedule for Week of February 11, 2024

The key reports this week are January CPI, Housing Starts, and Retail sales.

For manufacturing, the January Industrial Production report, and the February NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for January.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.2% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.0% year-over-year and core CPI to be up 3.8% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, down from 218 thousand last week.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.

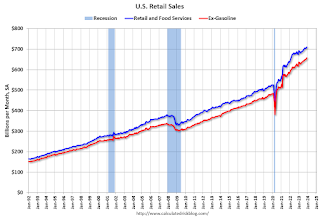

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of -12.5, up from -43.7.

8:30 AM: The Philly Fed manufacturing survey for February. The consensus is for a reading of -8.0, up from -10.6.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 46, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.470 million SAAR, up from 1.460 million SAAR.

8:30 AM ET: The Producer Price Index for January from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.1% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 79.0.