by Calculated Risk on 5/08/2024 02:53:00 PM

Wednesday, May 08, 2024

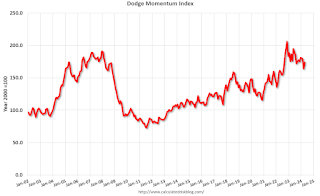

Leading Index for Commercial Real Estate Increased 6% in April

From Dodge Data Analytics: Dodge Momentum Index Rose 6% in April

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 6.1% in April to 173.9 (2000=100) from the revised March reading of 164.0. Over the month, commercial planning improved 12.6% and institutional planning dropped 6.3%.

“The Dodge Momentum Index (DMI) saw positive progress in April, alongside a deluge of data center projects that entered the planning stage,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Outsized demand to build Cloud and AI infrastructure is supporting above-average activity in the sector. Most other categories, however, faced slower growth over the month. Across these industries, it’s likely that owners and developers are grappling with uncertainty around interest rates and labor shortages, thus delaying their decisions to push projects into the planning queue. If interest rates begin to tick down in the latter half of 2024, more substantive growth in nonresidential planning activity should follow.”

A flood of data center projects entered planning in April, causing robust growth in the commercial segment of the DMI, while traditional office and hotel projects continued to face slower momentum. Warehouse planning was basically flat. On the institutional side, education and healthcare planning activity receded again – in part, driven by another month of weak life science and R&D laboratory activity. Year over year, the DMI was 1% lower than in April 2023. The commercial segment was up 6% from year-ago levels, while the institutional segment was down 15% over the same period.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 173.9 in April, up from 164.0 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a slowdown in 2024.

Commercial construction is typically a lagging economic indicator.