by Calculated Risk on 5/14/2024 11:00:00 AM

Tuesday, May 14, 2024

NY Fed Q1 Report: Household Debt and Delinquency Rates Increased

From the NY Fed: Household Debt Rose by $184 Billion in Q1 2024; Delinquency Transition Rates Increased Across All Debt Types

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

The New York Fed also issued an accompanying Liberty Street Economics blog post examining credit card utilization and its relationship with delinquency. The Quarterly Report also includes a one-page summary of key takeaways and their supporting data points.

“In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups,” said Joelle Scally, Regional Economic Principal within the Household and Public Policy Research Division at the New York Fed. “An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.”

Mortgage balances rose by $190 billion from the previous quarter and was $12.44 trillion at the end of March. Balances on home equity lines of credit (HELOC) increased by $16 billion, representing the eighth consecutive quarterly increase since Q1 2022, and now stand at $376 billion. Credit card balances decreased by $14 billion to $1.12 trillion. Other balances, which include retail cards and consumer loans, also decreased by $11 billion. Auto loan balances increased by $9 billion, continuing the upward trajectory seen since 2020, and now stand at $1.62 trillion.

Mortgage originations continued increasing at the same pace seen in the previous three quarters, and now stand at $403 billion. Aggregate limits on credit card accounts increased modestly by $63 billion, representing a 1.3% increase from the previous quarter. Limits on HELOC grew by $30 billion and have grown by 14% over the past two years, after 10 years of observed declines.

Aggregate delinquency rates increased in Q1 2024, with 3.2% of outstanding debt in some stage of delinquency at the end of March. Delinquency transition rates increased for all debt types. Annualized, approximately 8.9% of credit card balances and 7.9% of auto loans transitioned into delinquency. Delinquency transition rates for mortgages increased by 0.3 percentage points yet remain low by historic standards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

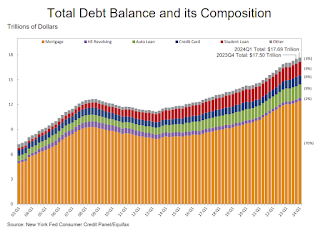

The first graph shows household debt increased in Q1. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $184 billion in the first quarter of 2024, a 1.1% rise from 2023Q4. Balances now stand at $17.69 trillion and have increased by $3.5 trillion since the end of 2019, just before the pandemic recession.

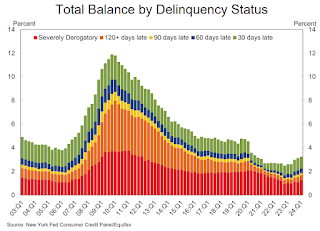

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q1. From the NY Fed:

Aggregate delinquency rates increased in the first quarter of 2024. As of March, 3.2% of outstanding debt was in some stage of delinquency, up by 0.1 percentage point from the fourth quarter. Still, overall delinquency rates remain 1.5 percentage points lower than the fourth quarter of 2019.

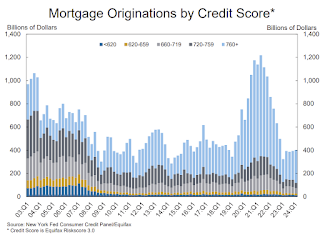

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Credit quality of newly originated loans was steady, with 3% of mortgages and 16% of auto loans originated to borrowers with credit scores under 620, roughly unchanged from the fourth quarter. The median credit score for newly originated mortgages was flat at 770, while the median credit score of newly originated auto loans was four points higher than last quarter at 724, the highest on record.There is much more in the report.