by Calculated Risk on 5/13/2024 08:10:00 PM

Monday, May 13, 2024

Tuesday: PPI, Fed Chair Powell, Q1 Quarterly Report on Household Debt and Credit

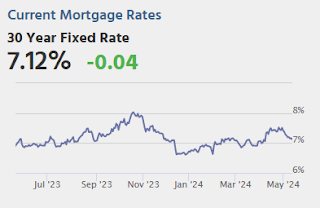

With essentially nothing on the event calendar to start the new week, it was fair to expect a continuation of the same sideways drift that characterized last week. It's not the future can ever be predicted when it comes to markets, but we can say the flat trajectory is the least surprising outcome for Monday. That same trajectory will be increasingly surprising over the next 2 days, with a special focus on Wednesday (CPI day). Even Tuesday deserves some respect with the Producer Price Index and a moderated discussion from a European banking conference with Fed Chair Powell. Today's Fed-speak wasn't worth any volatility, but the NY Fed's consumer survey showed an uptick in inflation expectations and made for a modest intraday bump at 11am ET. [30 year fixed 7.12%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

• At 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM: Discussion, Fed Chair Jerome H. Powell, Moderated Discussion with Chair Powell and De Nederlandsche Bank (DNB) President Klaas Knot, At the Annual General Meeting, Foreign Bankers’ Association, Amsterdam

• At 11:00 AM, NY Fed: Q1 Quarterly Report on Household Debt and Credit